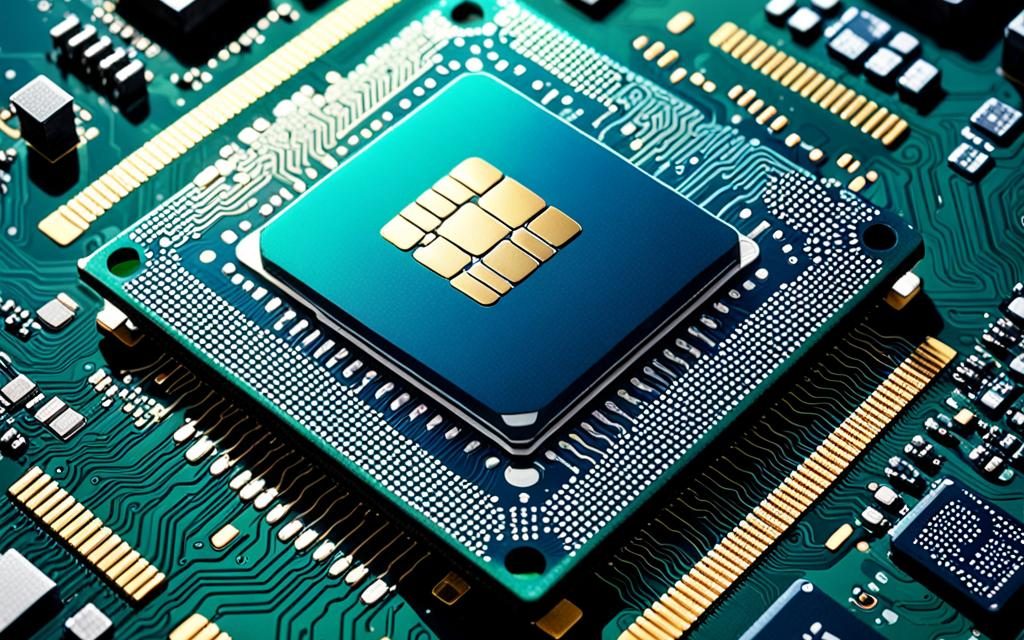

China Mandates Telcos to Swap Out US Chips for Domestic Silicon by 2027

Several years after the U.S. mandated its telecommunications providers to remove Huawei equipment from their networks due to security concerns, China has issued a reciprocal directive targeting American technology. Chinese authorities have recently instructed major telecom operators—including China Telecom, China Mobile, and China Unicom—to phase out foreign-made semiconductors, notably those produced by Intel and AMD, over the next three years.

This significant move by the Ministry of Industry and Information Technology underscores a deepening tech rift between China and the United States. Intel and AMD, two titans of the semiconductor industry, are poised to feel the impact profoundly; in 2023, these companies reported that the Chinese market constituted 27 percent and 15 percent of their total revenues, respectively.

The backdrop of this directive is the ongoing geopolitical tensions that flared up more than four years ago when the FCC banned telecommunications equipment from Chinese firms Huawei and ZTE from U.S. networks. The U.S. government expressed concerns that these companies could be compelled under Chinese law to implement backdoors in their equipment for espionage purposes—a claim Huawei has consistently denied.

In what appears to be a retaliatory measure, China’s decision could impose a significant financial burden on its own telecom operators, reminiscent of the cost U.S. carriers faced when replacing Huawei equipment. Despite a $1.9 billion fund established by the FCC to aid U.S. carriers, the actual requests for compensation surged to over $5.6 billion.

The tech landscape in China had already started to adapt even before this latest government directive. Late last year, Beijing endorsed a list of 18 CPUs for domestic use, conspicuously excluding products from Intel and AMD. This list includes x86 processors manufactured by Shanghai Zhaoxin Integrated Circuit Co, utilizing technology from Via Technologies.

The move to exclude Western technology and enhance self-reliance in semiconductor production has been accelerated by U.S. trade restrictions, which aim to block China from accessing advanced processing and chipmaking technologies. These technologies are crucial for developing capabilities in fields like artificial intelligence.

Despite these challenges, Chinese firms such as Huawei and SMIC (Semiconductor Manufacturing International Co) have made significant strides in developing competitive semiconductor technologies. Just this week, it was reported that Huawei is constructing a new research and development facility outside Shanghai to boost the development of domestic chipmaking technology, focusing on components for wireless networks and smartphones.

This tit-for-tat in the tech world reflects broader strategic tensions and highlights the increasing bifurcation of global technology ecosystems, which could have far-reaching implications for the global tech landscape.

Recent Comments